Columbia Bank, headquartered in Tacoma, Washington, has 145 branches and ATMs in communities around Washington, Oregon, and Idaho. There are five locations in Clark County. The bank has seen significant growth in the last decade, more than tripling its size in total assets. In that same period, the bank’s loan portfolio and total deposits have quadrupled.

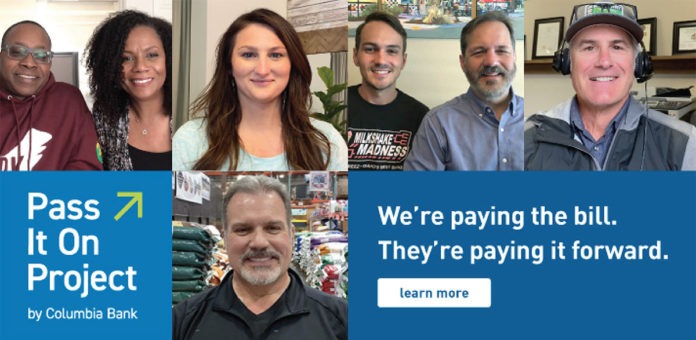

At the onset of the pandemic, Columbia Bank adapted quickly to serve its customers to the best of its ability. Team members worked especially hard to support small businesses. Kristy Weaver, SVP Regional Commercial Banking Manager at Columbia Bank says, “We knew there was more we could do to support small businesses and recovery efforts. In 2020 we launched our ‘Pass It On’ Project, dedicating funding to pay small businesses to perform services for people whose lives were impacted by the pandemic and the ensuing economic downturn. We sought to help small businesses that identified a person or group of people that had a need for their service in their community, and we paid the bill for the business to perform the service. Services ranged from food deliveries and home maintenance to dental work and auto body repair.” At the end of the year, the bank had helped over 370 businesses and paid more than $600,000 to local businesses in the Northwest.

The bank was also strategic in helping businesses obtain funding through the Paycheck Protection Program. They funded nearly $1 billion to more than 4,400 small businesses in the first round. They have continued to help businesses in the most recent round of funding that began early this year.

Recently, the bank was honored as #1 Bank in the Northwest and the 20th Best Bank in the Nation on the Forbes 2020 List of ‘America’s Best Banks’. Weaver shares, “Our strong commitment to highly personalized service, innovative solutions and long-standing community presence attracts extraordinarily smart and devoted team members who take a relationship-based approach to working with clients. We take the time to get to know our clients, their businesses and their industry so we can collaborate and offer solutions that specifically meet their needs.”