The Portland-Vancouver metro area has been selected by Wells Faro as one of a handful of markets around the nation to utilize the company’s latest service offering: mobile check deposit.

The Portland-Vancouver metro area has been selected by Wells Faro as one of a handful of markets around the nation to utilize the company’s latest service offering: mobile check deposit.

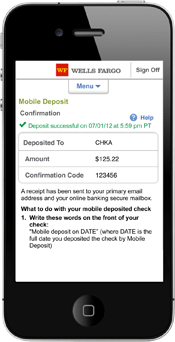

After downloading an app, mobile check deposit allows Wells Fargo customers to deposit checks into their accounts simply by taking a photo with their smartphone or tablet.

Security was the number one priority when constructing the app, according to Brian Pearce, Wells Fargo’s retail mobile channel head. In addition to being password protected, Pearce said check photos taken by the mobile device are not stored locally, rather directly sent to Wells Fargo’s mainframe.

The technology used in the bank’s mobile app is not completely new, said Pearce. It first saw action with Wells Fargo’s envelope-free ATM function, where checks would be scanned and sent to the bank electronically, instead of physically delivered.

The technology used in the bank’s mobile app is not completely new, said Pearce. It first saw action with Wells Fargo’s envelope-free ATM function, where checks would be scanned and sent to the bank electronically, instead of physically delivered.

Tom Unger, Wells Fargo VP and Oregon regional manager, hypothesized that the app would appeal not only to urban users, but to rural residents who may be 20 or more miles away from a physical branch. Additionally, he said small business owners are projected to be high users of the app due to the ease of depositing checks instantaneously.

Mobile deposit technology is not without flaws. App users have reported difficulty with taking pictures of their checks, often due to background glare or an imprecise angle of capture. Pearce said Wells Fargo has responded to the user feedback, making the app instantly identify any problems during the picture taking process and prompting the user to try again.

Wells Fargo hopes to bring mobile deposit to every state by the end of 2012.

Mobile deposit is just one of several digital finance-related trends to watch in the second half of 2012. To read more about trends in digital finance, check out the Friday, July 27 edition of the Vancouver Business Journal.