The summer real estate season is just around the corner, but don’t expect much luck if you’re a bargain shopper – from rural to urban areas across Clark County, the seller’s market reigns.

Home purchasing and sales generally parallel the school year, with families reluctant to move while children are still in class. The busy summer season hasn’t quite launched yet, but the overall market is so tight that realtors aren’t expecting much availability on the lower cost end of the housing spectrum when it does. And that’s true countywide, not just in more densely populated Vancouver, said Beverly Brissler, a Coldwell Banker Realtor in North Clark County.

“The American dream is to live in the country and have some animals and acreage,” Brissler said. “However, reality sets in and there aren’t a lot of affordable options that meet that description.”

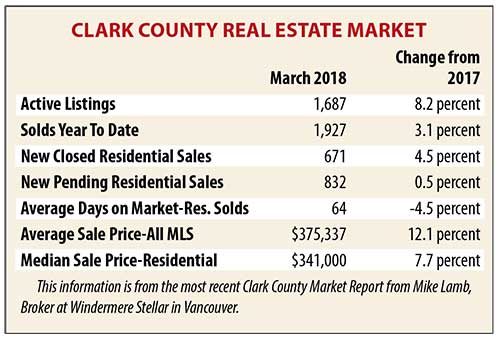

In March, the county had only a 1.6 month supply of housing available, compared with the still tight 2.2 in January and 1.9 in February. If you compare that with the housing bust after the Great Recession, the vacancy rates are startlingly low, she added.

“When the pendulum went the other way, we’ve had 15 to 18 months of inventory,” Brissler said. “The pendulum swings back and forth. Right now it’s a heavy sellers market.”

When realtors have less than six months of inventory available, it’s dubbed a seller’s market. When they have more than six months available, it’s called a buyer’s market, she added.

And overall the county currently has about half of what would be considered a normal amount of inventory, said Rian Davis, public affairs director with the Clark County Association of Realtors.

“With a tight market, a lot of people are just buying (lower-end housing) wherever they can go,” Davis said. “There’s not really a specific part of town or anything. Everything’s really tight.”

Reasons for the tight market are legion.

For one thing, the population in the county is rapidly growing, with about 1,500 new residents coming to the area each month. From 2014 to 2016, the county grew by an average of 18,365 people per year. The U.S. Census Bureau also recently listed Washington as the fourth fastest growing state in the country. From April 2010 to July 2017, the county experienced 11.6 percent population growth, according to census data. And so far, there’s no sign that trend is slowing down.

Another problem is that there aren’t enough developable lots to address the rising demand. That’s something the Clark County Association of Realtors is eager to address, but negotiations and legal hurdles complicate that process, Davis said.

“It’s hard to tell when we will get that relief and how it will happen,” he said.

There is more vacant land on the market, with 314 active vacant land listings in the county at the end of April, up from 291 in early April. Unlike homes, there’s a 15-month supply of land on the market right now, which means it’s more of a buyer’s market. But much of that land just isn’t suitable for housing, Brissler said.

“There’s a lot of stuff out there that’s just not buildable,” she said.

Generational moving patterns are also playing a big factor in housing market supply and cost.

Millennials and younger generations want to live in more populated city areas, often because they’re closer to work and nightlife. They’re generally looking for smaller homes and condos in Vancouver.

Baby Boomers and older generations, on the other hand, are looking to retire and downsize to smaller homes in the country. And even some that live in larger country homes are looking to downsize to smaller ones in the same areas, Brissler said.

Baby Boomers and older generations, on the other hand, are looking to retire and downsize to smaller homes in the country. And even some that live in larger country homes are looking to downsize to smaller ones in the same areas, Brissler said.

“Most seniors want new homes, single level,” she said. “Boomers who are over 60 tend to be the ones buying homes in rural parts of the county. They have pensions, social security and savings. And there’s a lot of downsizing going on right now. That’s where the market is brisk.”

A lot of retirees are also looking to move to rural towns in Clark County from Oregon, because they like that Washington has no income tax, she added.

But the problem remains that both of those demographics, while looking in separate regions of the county, are looking for smaller homes.

“Right now we’re just in such a tight market, it’s a challenge for folks wanting to get into it,” Davis said. “It’s a challenge when you want to downsize, and a challenge looking for starter homes.”

A lot of the properties under $300,000 have been purchased by investors with cash in hand, also, which has removed a chunk of affordable housing from the market, Brissler said.

“Those properties go to investors who have cash,” she said.

And other prices pretty much across the board have spiked – increasing between 10 and 12 percent in the last year, Brissler said.

“People who want the big houses in rural areas right now, they’re the ones that have options, but they have to have the money,” Brissler said.

Still, it’s important to remember that real estate markets tend to be cyclical. And while there’s no indication that population growth or demographic moving trends will change anytime soon, it’s still likely that more busts and booms will come in the future, Brissler added.

“The trend changes like the snap of a finger,” she said.