A continued increase in construction has once again helped boost Washington state’s taxable retail sales in the first quarter of 2019 by 4.9% over the same period in 2018, reaching $39.4 billion, according to a news release from the Washington State Department of Revenue (DOR).

Locally, according to the news release, taxable retail sales in Clark County hit $1.9 billion during the first quarter of 2019, a 6.9% increase. The city of Vancouver saw $1 billion in taxable retail sales, an increase of 5.2%. The city in Clark County that saw the largest percentage jump in taxable retail sales during the first quarter, however, was Ridgefield with $85.1 million, an increase of 61.28%.

According to the DOR news release, retail trade, a subset of all taxable retail sales in the state, also increased by 4.6% to a total of $16.5 billion. Taxable retail sales are transactions subject to the retail sales tax, including sales by retailers, the construction industry, manufacturing and other sectors. Retail trade includes sales of items such as clothing, furniture and automobiles, but excludes other industries, such as services and construction.

These figures are part of a quarterly report released today by the Washington State Department of Revenue. The taxable retail sales figures compare the same quarter year-over-year to equalize any seasonal effects that would influence consumer and business spending.

According to table with the news release, Battle Ground saw an increase of 7.18%; La Center saw a 10.68% increase; Washougal had a 4.65% increase; and Yacolt saw a 6.06% increase. The only city that saw fewer taxable retail sales during the first quarter was Camas with a 5.79% decrease.

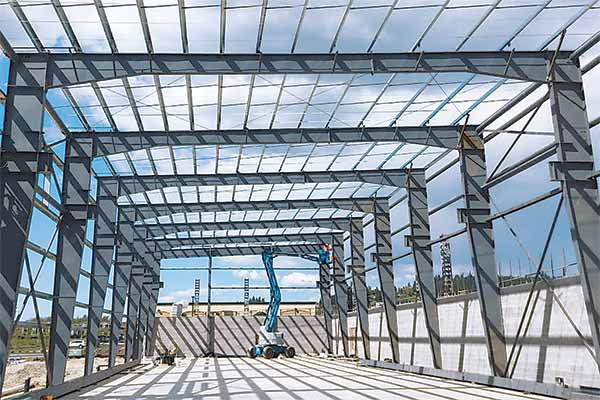

According to the news release, the increase in taxable retail sales in the state is in large part a result of the steady increase in construction. In the state, construction rose 8% to a total of $8 billion. Building materials, garden equipment and supplies sales rose $3.4% to $1.6 billion.

“The growth Clark County is experiencing naturally brings with it taxable retail sales, but commercial construction acts as a big part of it,” said Nelson Holmberg, executive director of the Southwest Washington Contractors Association. “We are excited that our members are busy, and that there seems to be a sustainable backlog of work, so we anticipate seeing the increase in taxable retail sales continuing to trend upwards.”

Holmberg also said that the construction industry certainly contributes to the sales tax increase in its own right, using the example of if rock mines were to shut down, “there would be a substantial hit in received sales tax since our members are paying sales tax on every load from the quarry.” He said those taxes help pay for fixing roads and supporting the community.

“The number of residential and commercial building permits issued in Clark County hasn’t increased year-to-date over last year, however, valuation of permits issued has increased by 2.6%,” said Avaly Scarpelli, executive director of the BIA of Clark County. “Although permit valuation doesn’t reflect actual cost of the project, the increase in retail sales tax revenue is primarily due to the increase in price of construction materials. Many of our builders report experiencing quarterly increases in building material costs, most citing the impact of manufacturers passing along tariff costs.”

Holmberg also pointed out that construction is a “multiplier industry, so one construction job supports as many as five other jobs in the community.”

“Imagine if construction slowed down – what would it do to the gas stations, barber shops and entertainment venues – not to mention overall sales tax receipts?” Holmberg said. “Jobs are always good for a community, whether they are in construction or in retail. It’s no secret the jobs that are being added around the county are promoting the increase in taxable retail sales as people have more flexibility in their spending.”