I got a call from a client the other day asking if I had ever seen anything like this before. I thought about it for a second and realized I have had the fortune (or misfortune depending on how you look at it) of living through three major market crises. I lived through 9/11 and the tech bubble in the early 2000s, the financial crisis and Great Recession of 2008, and now this COVID-19 Pandemic. All three of those crises have a couple of things in common. First, the market had a major sell off and each time set many records. And second, each of those events had never happened before at that time.

I’m sure you all have been reading and hearing the things you are supposed to do with your portfolio at a time like this. Strategies like making sure you have a plan, not making short-term panic decisions to your long-term investment portfolio and taking advantage of low prices on stocks by rebalancing are all great things to do. I completely agree with all of them. In writing this article though, I thought it would be best to not say the same thing you have probably read many times by now, but rather provide some much-needed perspective.

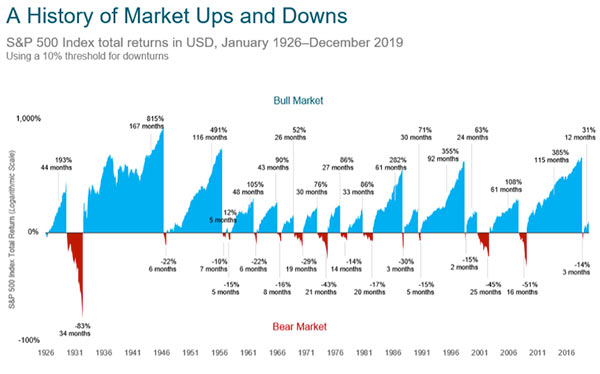

Below is a graphical representation of all the Bull and Bear Markets we have seen in the stock market since 1926. What jumps off the page right away is the massive difference between the length and return difference between the two. Since 1926 we have had 16 major market declines that have yielded an average drop of -28% and lasted on average 12 months. On the other hand, coming out of each of those down markets we have had up markets with an average gain of 176% that last 58 months. While downturns are very painful as we go through them, if you take a step back and take a longer view of all of these events, the “bad times” in markets have been quite short lived compared to the “good times.”

We are getting a lot of questions from clients these days, but I think one of the most reassuring things I have been able to share with them is the information on this graph. Many investors watch their portfolios drop and feel like it is going to take years and years to get back to where they were before the downturns. It is important to remember past performance is not a guarantee of future results and we do not know for sure what will happen this time. History has shown us that it has not taken that long to recover from past bear markets and downturns.

Interestingly enough, this COVID -19 Pandemic did cause the stock market to set a record for the fastest Bear Market of all time. I am sitting in my office right now at 1 p.m. on March 24 typing this article and the Dow Jones Industrial Average just set a record for the biggest percentage gain in one day! Again, nobody knows for sure how this will all end but history has shown that when markets drop quickly, they can recover quickly.

Todd Pisarczyk is the founder of Vancouver-based investment management and financial planning firm Sustainable Wealth Management. He specializes in asset management, and financial, retirement income and estate planning. He can be reached at todd@sustainablewealthmgt.com. Investment advisory services offered through Sustainable Wealth Management, Inc. Investment advisory services and securities offered through KMS Financial Services, Inc. Each entity is separately owned.