1. Larger employers must report the value of health care coverage on employees’ W-2 forms. As of 2012, employers that issue 250 or more W-2s in the prior tax year must report the cost of health care coverage on employees’ W-2 forms. This means that employers that issued 250 W-2s in 2011 were to include this additional information on the 2012 W-2 forms that were issued in January 2013. This reporting is optional for employers that issued fewer than 250 W-2s in the prior tax year.

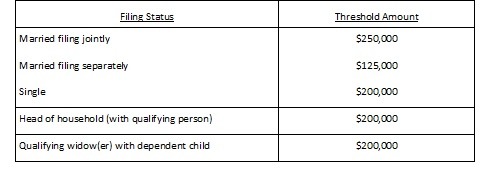

2. Increased Medicare tax withholding rates apply to certain higher-earning employees. Highly compensated employees are required to pay increased Medicare taxes (.9 percent) on earnings after December 31, 2012. Employers need to be prepared to appropriately withhold and report these additional taxes once the employee’s taxable income reaches the following threshold amounts:

3. Flexible Spending Account (FSA) contributions are capped at $2,500. A $2,500 FSA cap is effective for plan years starting January 1, 2013.

4. Certain health care plans must cover women’s preventive services at no additional cost. Non-grandfathered health plans must cover women’s “preventive services” (i.e. contraception, cancer screenings, mammograms, prenatal care, etc.) without co-pay, co-insurance or deductible in the first policy year that begins on or after August 1, 2012. For calendar-year plans, that means January 1, 2013.

5. Existing employees and new hires must receive a mandatory notice about health care once the deadline is announced. Employers governed by the Fair Labor Standards Act (FLSA), the federal minimum wage, overtime and child labor laws were originally instructed to send a required health care exchange notification to employees and new hires beginning on March 1, 2013. That date was later postponed indefinitely. According to this month’s announcement from the Obama Administration, a new deadline, as well as a sample notice, may be announced in late summer.

Remember, this is a general discussion of health reform-related rules that continue to develop and is not intended to substitute for legal advice for specific circumstances. Some or all of the information is subject to change as insurance exchanges continue to take shape and various states and federal agencies continue to enact enforcement guidance and fine-tune rules, obligations and resources.

Of course, if you have a specific question about any of the requirements included in this article or any individual compliance requirements applicable to your business, please consult your legal counsel or qualified tax professional.

Amy Robinson is a shareholder practicing in Jordan Ramis PC’s employment and business practice groups. She can be reached at 360.567.3907 or amy.robinson@jordanramis.com.

{jathumbnail off}